Four In 10 Retirees Say “I Wish I’d Filed For Social Security Later”

MassMutual Social Security Pulse Check Reveals Many Regret Their Timing On Claiming Benefits

If you can, wait. That’s the advice from today’s to tomorrow’s retirees. In a new survey commissioned with Age Friendly Ventures (which operates this website, AgeFriendly.com), the MassMutual Social Security Pulse Check accessed people in their 70’s who are ‘paying it forward’, advising the next generation to defer claiming social security benefits in order to maximize monthly payments.

“When you retire and file for Social Security retirement benefits should be your choice, and this study underscores the need to plan ahead for the unforeseen and save as much as you can,” said Mike Fanning, head of MassMutual US. “Many are not saving enough for retirement and need to access funds the minute they can -- regardless of the longer term impact of the decision – and in some cases, unforeseen health issues are complicating the issue.”

Key Survey Findings

- Three out of 10 (30%) filed at age 62 or younger

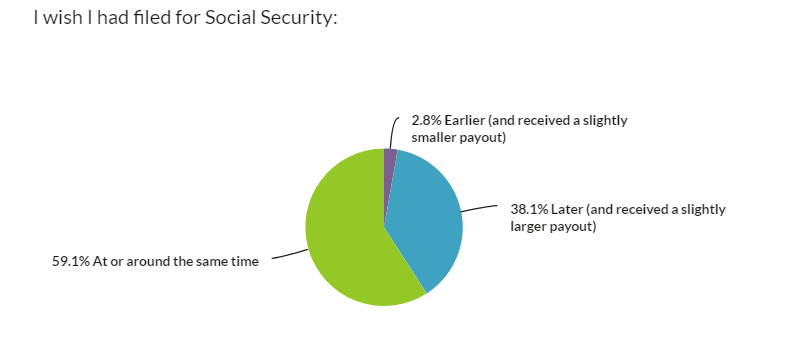

- Nearly 4 out of 10 (38%) wished they filed later

- More than half (53%) filed out financial necessity, such as not saving enough , and another one-third (30%) filed as the result of unforeseen issues, such as health issues or employment changes

“Retirement and social security should be an informed choice,” said Tim Driver, founder of Age Friendly Ventures. “However, often they are not sufficiently informed and they are not a choice.” More than half of early filers had to file when they did due to financial necessity. In some cases, they had lost their jobs or suffered injury or illness. Roughly 60% didn't get help or advice on when to file. Only 8% filed as the result of consulting with a financial advisor.

"When you claim your Social Security benefit is one of the most important decisions about your retirement,” says Alicia Munnell, director of the Center for Retirement Research at Boston College. “The longer you delay claiming Social Security, the higher the monthly benefit you, and if married, your spouse will receive for the rest of your lives and the larger the benefit for your surviving husband or wife.”

“People not being able to sustain for very long on what they’ve saved appears to be a common occurrence today,” said Fanning. “This study reveals that many are leaving money on the table that they’re eligible for – and that they could have received for many years to come. Planning ahead for the foreseen – and the unforeseen – appears to be the ‘pay it forward’ message from today’s to tomorrow’s retirees.”

In the simplest and most conservative cumulative calculation, a married couple with longevity into their early 90’s could be leaving more than a half million dollars on the table – or as much as $2-4,000 per month for life – by filing for Social Security retirement benefits at age 62 versus filing at age 70. Furthermore, a surviving spouse could receive $1-2,000 per month less for life as a result of filing at age 62.

The majority of survey respondents (79%) to the MassMutual Social Security Pulse Check felt that they had the appropriate amount of information about when to file for Social Security retirement benefits, and nearly 6 out of 10 (58%) didn’t get help or advice.

“The interesting thing about Social Security modeling is that every person and every couple is different,” said David Freitag, a financial planning consultant with MassMutual. “It is hard to make relevant generalizations about filing strategies. In reality, each person needs to do a careful analysis based on their unique situation in life to help ensure they are not leaving money on the table for years to come, and a financial advisor can help.”

========

By How Much Would Your Social Security Be Reduced? Use Our Calculator to Help Determine An Answer For Your Particular Situation.

========

The 2019 MassMutual Social Security Pulse Check was conducted by Age Friendly Ventures via an online survey of 618 individuals age 70+ in March and April.

Take your SS monies at 62...the equality of ACCUMULATED wealth is around age 82 when comparing starting SS at 62 vs 66.25 years.

If you file at 62, how much money can you make from working a side job before it effects the Social Security check?

2 things you must consider:

• How does one know you’re going to be around at age 65+?

• How does one know SS is going to be around in the future?

Few consider ACCUMULATED SS wealth. If I take SS at 62, and add the amount you’ll receive each month to, say, age 82,

Then compare that total from age 66 yrs, 4 months for those born in 1956 to your age 82 with that higher monthly SS check.

The amounts are about equal in my case.

Now consider that at age 82, do I really need more money? I’ve had the advantage of having my SS monies NOW for the years between 62 yr and 66 yr, 4 mo in years when I’m certainly more agile and spry.

And if you now consider your health and typical death ages in your family, why the hell not grab my SS contributions over my preceding 40-yr work life.

The only reason you read such stories about waiting to file for SS is bc the govt needs your SS contributions for other Liberal social spending programs.

Moreover, if you’re in some technical field, your technical edge is filled as compared to younger people more familiar with programming and the like.

If you’ve saved properly over your 40-yr with life, you should have enough in your 401k, company stock, or pensions to redivest in income-producing no/low-tax investments.

I’m now enjoying life of ease and peacefulness that I’ve earned to focus on family and home we often neglect in the preceding years.

I say, overcome the fear of not earning a paycheck, file for SS as soon as you can and enjoy life. And if that means waiting for Medicare at age 65, file the day you turn 66 (actually you can file 2 months before you become 65)!

The wild card here is an employer can force you into an early retirement, with no prior warning, by outsourcing your seemingly secure job overseas. Once you are unemployed, and over 50, NO ONE wants to hire you, claiming you are "overqualified" for a lower paying job you would gladly take. The real story is that you can be so quickly and easily forced out, despite being in good health, and performing well, with no intention to retire before 65.