Four In 10 Retirees Say “I Wish I’d Filed For Social Security Later”

MassMutual Social Security Pulse Check Reveals Many Regret Their Timing On Claiming Benefits

If you can, wait. That’s the advice from today’s to tomorrow’s retirees. In a new survey commissioned with Age Friendly Ventures (which operates this website, AgeFriendly.com), the MassMutual Social Security Pulse Check accessed people in their 70’s who are ‘paying it forward’, advising the next generation to defer claiming social security benefits in order to maximize monthly payments.

“When you retire and file for Social Security retirement benefits should be your choice, and this study underscores the need to plan ahead for the unforeseen and save as much as you can,” said Mike Fanning, head of MassMutual US. “Many are not saving enough for retirement and need to access funds the minute they can -- regardless of the longer term impact of the decision – and in some cases, unforeseen health issues are complicating the issue.”

Key Survey Findings

- Three out of 10 (30%) filed at age 62 or younger

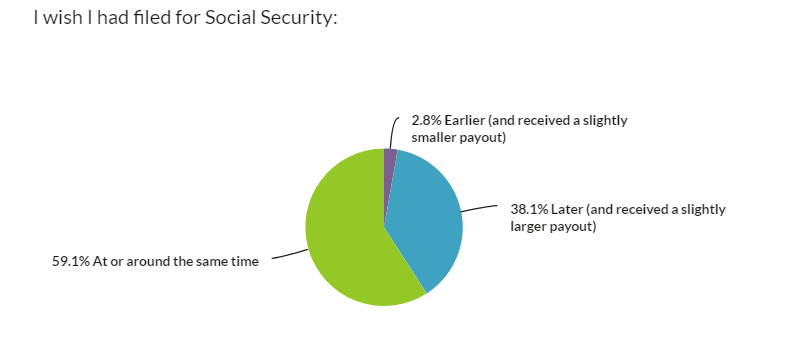

- Nearly 4 out of 10 (38%) wished they filed later

- More than half (53%) filed out financial necessity, such as not saving enough , and another one-third (30%) filed as the result of unforeseen issues, such as health issues or employment changes

“Retirement and social security should be an informed choice,” said Tim Driver, founder of Age Friendly Ventures. “However, often they are not sufficiently informed and they are not a choice.” More than half of early filers had to file when they did due to financial necessity. In some cases, they had lost their jobs or suffered injury or illness. Roughly 60% didn't get help or advice on when to file. Only 8% filed as the result of consulting with a financial advisor.

"When you claim your Social Security benefit is one of the most important decisions about your retirement,” says Alicia Munnell, director of the Center for Retirement Research at Boston College. “The longer you delay claiming Social Security, the higher the monthly benefit you, and if married, your spouse will receive for the rest of your lives and the larger the benefit for your surviving husband or wife.”

“People not being able to sustain for very long on what they’ve saved appears to be a common occurrence today,” said Fanning. “This study reveals that many are leaving money on the table that they’re eligible for – and that they could have received for many years to come. Planning ahead for the foreseen – and the unforeseen – appears to be the ‘pay it forward’ message from today’s to tomorrow’s retirees.”

In the simplest and most conservative cumulative calculation, a married couple with longevity into their early 90’s could be leaving more than a half million dollars on the table – or as much as $2-4,000 per month for life – by filing for Social Security retirement benefits at age 62 versus filing at age 70. Furthermore, a surviving spouse could receive $1-2,000 per month less for life as a result of filing at age 62.

The majority of survey respondents (79%) to the MassMutual Social Security Pulse Check felt that they had the appropriate amount of information about when to file for Social Security retirement benefits, and nearly 6 out of 10 (58%) didn’t get help or advice.

“The interesting thing about Social Security modeling is that every person and every couple is different,” said David Freitag, a financial planning consultant with MassMutual. “It is hard to make relevant generalizations about filing strategies. In reality, each person needs to do a careful analysis based on their unique situation in life to help ensure they are not leaving money on the table for years to come, and a financial advisor can help.”

========

By How Much Would Your Social Security Be Reduced? Use Our Calculator to Help Determine An Answer For Your Particular Situation.

========

The 2019 MassMutual Social Security Pulse Check was conducted by Age Friendly Ventures via an online survey of 618 individuals age 70+ in March and April.

Si quiero un buen trabajo

Just need to point out that your life expectancy is NOT 78 as a lot of people seem to think. If you are looking at taking Social Security your life expectancy is well beyond 78.

The 78 number is for a new born.

Wanda, the reduction you'd make by working while collecting your Social Security before your Full Retirement Age (FRA) WILL be repaid once you hit FRA.

However, the reduction in benefits by filing early are permanent! Proceed with extreme caution of taking an early benefit.

I retired at 62 due to job loss; shortly thereafter I had severe medical problems. The SS agent told me that if I live to age 77 I would collect the same amount of money as someone who retired at the official retirement age. I will try to take care of myself and live even longer! I retired at 62 due to job loss and also debilitating illness. If I manage to live to 77 I may get the same amount as if I would draw SS at my retirement age of 67 and 7 months.

Wanda, a little over $17,000. Divide that by a per-hour salary to figure the translation to the number of hours that equates to.