Reboot, Rewire or Retire? Personal Experiences With Phased Retirement

This article provides insights from my personal experience and that of friends, and people I have talked with about our retirements and about what has made retirement work well for us.

This article provides insights from my personal experience and that of friends, and people I have talked with about our retirements and about what has made retirement work well for us.

Let me introduce myself. I am an actuary, and I am 78 years old. For many years, I have been passionate about improving the retirement system, helping late career individuals decide how to transition from full-time work to life paths that work well for them, and women’s issues. For many years, I have thought about the transition from full-time work to total exit from employment, the steps involved, and the interests of different stakeholders. For 28 years before my retirement, I was a retirement consultant at Mercer, a major benefits consulting firm. As a retirement benefit consultant, I started focusing on phased retirement and business issues for plan sponsors, but I have now shifted to primarily focusing on the viewpoint of the individual. I have been an active volunteer for the Society of Actuaries (SOA) for 50 years, served as SOA President 20 years ago, and have chaired its Committee on Post-Retirement Needs and Risks since its inception about 20 years ago. I currently also chair the SOA’s Aging and Retirement Research Program steering committee. In these 20 years, the SOA has sponsored numerous research projects and paper calls focused on understanding and improving the management of retirement. This article combines my personal thoughts, my perspectives on employers and their benefits, the results of SOA research, and the experiences of others with whom I have talked and spoken.

Since retiring from Mercer at the end of 2004, I have given significant thought to managing my own retirement while continuing to be an active phased retiree. I have also talked with many other people and conducted roundtables focused on the journey after full-time work.

Many advisors focus on helping clients manage their money. This article focuses on a different aspect of managing retirement: managing life beyond money (it assumes that financial management is under control and that there are adequate financial resources).

My personal path has included a combination of contract work, writing and speaking, not-for-profit Board service, research, and a lot of volunteer work, plus spending time building my art and painting skills. I have also talked to a number of others about their own paths and tried to help people think through their retirement journeys.

Many individuals in their 50s, 60s, and 70s are faced with making important decisions about their next steps, sometimes by choice and sometimes not. Some are seeking a new, but similar job opportunity; some are seeking a new active lifestyle but with a different script; and some are seeking traditional retirement. My experience with professional and business people is that most of them are seeking a meaningful set of activities and not just a full-stop retirement, but what that means is very different from person to person.

Life Paths For Professional People In Their 50s And 60s

Based on my experience, discussions with others, and Society of Actuaries’ research, some observations jump out at me:

While there are well-established ideas about career planning, the ideas about next steps for people at this life stage are much less developed. People feel like they are writing their own scripts without guidance.

- Some people reach transition points unsure about when to make a move, what steps to take, and with no idea about what they will do when they reboot or retire.

- Some people decide to move to next steps without any well-thought-out financial analysis of the implications of beginning retirement or scaling down their income.

- One cannot be on vacation all of the time. Vacation is a break from what we normally do. People who retire with the idea of an endless vacation are likely to be disappointed or bored within a year or two, if not sooner.

There is a huge variation in the financial situation of people at this life stage. Some have the resources to make choices without being concerned about how much money they will earn in the next few years, whereas others are concerned about continued income and need at least a defined level of earnings if they are to maintain their preferred lifestyle.

This article is not focused on providing ideas that will help retirees earn more money, but rather it is focused on helping people find activities they feel are purposeful within their means. However, it also indirectly highlights the richness of potential conversations that financial advisors themselves could have with their prospective retiree clients, beyond just the dollars and cents of their ability to afford retirement itself.

A Diversity Of Directions And Ideas

Often, rebooting means the individual is scaling down somewhat and choosing some form of phased retirement. Sadly, institutional support for flexible job options is scarce. The GAO did a new study in 2017, Older Workers: Phased Retirement Programs, although Uncommon, Provide Flexibility for Workers and Employers, Report-17-536. The GAO interviewed both employers and experts and found few formal phased retirement programs. They presented evidence that many people are working as part of retirement, thus creating their own phased retirement. In 2006, the Pension Protection Act enabled phased retirement, but most employers have not changed their approach much since then.

More generally, though, individuals themselves have very different ideas of what they would like to do as they enter retirement. New directions are often referred to as bridge jobs and encore careers. Ideas include:

- Many want to do some purposeful activity, and some get to the point of transition with a good idea of what to do, but others need to find their next steps after the transition. Those who transition to purposeful activities after full-time work may then transition to total retirement a few years later.

- Some would like to continue working at traditional jobs well into their 70s and some after age 80. Judges, members of Congress, and entrepreneurs (including financial advisors!) tend to work to high ages.

- Others would like to leave traditional full-time roles early and build an independent new role. Corporate employees are much more likely to leave early (and this is often not entirely a voluntary decision).

- Small business owners have different kinds of choices, including transitioning part of the business to someone else.

- Some people are interested in volunteer and not-for-profit roles, working or volunteering in areas that are meaningful to them (but that may involve little or no compensation because the individuals are no longer involved in regular jobs or significantly paid roles).

- Some senior people seek roles on Boards, with a mix of corporate and not-for-profit organizations.

- Some people are interested in consulting but at various levels of effort.

- Some are seriously interested in music or art, maybe in combination with some of the other roles. An interest in art can strictly be a hobby, or the individual might try to sell their artwork, secure roles teaching, etc.

People in senior management or professional roles often want a period of professional activity of their choosing before totally leaving such roles. In discussion with people who had switched roles a few years ago, some were ready for total retirement, and others were thinking about timing. A few never totally leave their professional roots.

The Life Portfolio

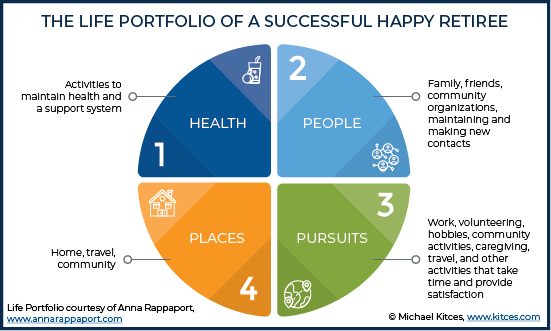

From my perspective, each of us should have a life portfolio as well as a financial portfolio. Just as a financial portfolio requires focus, diversification, and management, so does a life portfolio. However, the strategies that make sense for the life portfolio are very individual, and there are few established tracks for defining and managing a life portfolio.

I have defined four components of the life portfolio:

The couple developing a life portfolio needs to think about which of their goals are shared and which are individual to each of them. Bringing the two sets of goals together, and deciding how to meet individual needs, is a part of the planning process. Many couples may each have a life portfolio, and they can have a joint life portfolio that overlaps the two.

Those who come from professional services roles often engage in a more phased retirement and maintain a wider array of pursuits. Some components of my own Pursuits portfolio are as follows:

- I view myself as a phased retiree. I have stayed very active professionally, and hope to continue to do so.

- I seek paid consulting assignments consistent with my interests.

- Volunteering in areas that I view as important is a good way to give back, while at the same time doing something that I enjoy.

- Research, writing, and speaking are important to me.

- I am also an artist and have worked to balance a continued actuarial and retirement system focus with making art.

- I place a high value on family commitments and do not get involved in projects that will create difficulty with meeting family priorities. This is a choice that someone with a regular job often can’t make.

- I work regularly to maintain and build contacts.

- I only do projects that are of interest to me, and which I can do on my own without staff. I may partner with others and have others help me.

- Advisory group roles can fit well into what I want to do.

- I am creative and seek to apply that creativity in both professional work and art.

- I want to feel that what I do has value.

- I manage my pursuits to limit the financial outlay I must make to pursue them. At the same time, I do not set priorities based on making money. I avoid overhead but get help with specific targeted tasks. This enables me to focus on what is worthwhile, in a way that limits the use of retirement assets to support the pursuits.

For many people, a big part of the planning process for the life portfolio may relate to Places. Just a few of the questions to think about are: Do I want to move to different housing or a different area? Would I like to be a snowbird? How much do I want to travel? Some examples of my thinking and that of some of my friends are as follows:

- Some cities are much more age-friendly than others. It is worth paying attention to this point.

- Access to family and desirable health care are very important to some people. Transportation and services are also important issues.

- I want to stay where I am, at least for part of the year, because:

- I have a lot of friends and contacts there.

- I love the parks, museums, culture, and the city.

- My husband and I have long-term relationships with doctors we really like, and the city has outstanding medical care.

- The climate is great in my home city in summer (but not good in mid-winter).

- I like having a warm weather home and spending part of the year there. I have chosen a place near friends and good activities.

- We have taken many cruises, usually with a small group of friends or family. That offers a great solution when there are people with different interests and levels of mobility in the group. People can do what they want during the day, and everyone can meet for dinner.

- I observe that some travel is physically quite demanding, and it is smart to do things while one can. We may find that some of what we loved to do at one time is no longer feasible as we age.

- Many of the people who travel a lot early in retirement travel much less later.

- Many of my friends who are also snowbirds have downsized their main homes so that while they have more than one place to maintain, they try to simplify.

- Some people choose to completely move to a different area after retirement. Reasons include better climate, less traffic, lower cost, and access to special interests. Some people choose either retirement communities or communities where there are a lot of retirees present.

- Cities, neighborhoods and gated communities often offer access to a wide range of activities, many of which are for seniors or limited to residents. Many of these activities are available at very reasonable cost or no additional cost. This is particularly true of activities organized by volunteers.

- Some of the people who move to a different location after retirement (or who snowbird) may return to the original location when their health fails, because of concerns about health care at the new location.

There is a wide variety of senior housing that includes a range of services. Discussion of such housing is beyond this article.

People are also a very important part of retirement planning and building a life portfolio. I have observed personally and from researching several things:

- When people need help, particularly at high ages, family often steps in. It is not unusual for people to move to be near family, and this can go either way. Seniors may move to be near their children, and adult children may go to be with their parents for a while.

- Decisions about where to live may be made keeping family in mind. Other people make their own decisions and are not concerned about family.

- We bought our snowbird home in a gated community with hotel and resort facilities, as well as private homes. We had friends who lived or vacationed there before we bought the house, and we have appreciated that ever since. We like the fact that people help each other out, and it makes us feel much more comfortable.

- Meeting people and become friends is a major challenge in many areas. Big cities can be particularly difficult in that regard.

- Maintaining health and having access to good health care are important to people in retirement. The big things to think about are doing things to stay healthy and having access to a good health care system. However, as we age, we need to learn to live with limitations. Getting support is an important part of living with such limitations. Support can come from family, friends, or the market. Marketplace sources of support can be formal or informal.

Building and Maintaining The Life Portfolio

As we age, we often become limited in what we can do. Ideally, the life portfolio has some flexibility to adjust to limitations. Technology can often assist in compensating for some limitations. I believe it is important to include some elements in a life portfolio that can be continued even if one is physically limited or significantly involved in caring for others.

Some people will work on building a life portfolio long before they retire, and others will not start until after they have retired. My view is that it is better to start on this before retirement and to have some pieces of a life portfolio in place, or ready to be put in place quickly.

A friend who is now doing significant volunteer work for the Society of Actuaries observed that getting elected to an SOA Section Council two years before retirement opened up a new world to her and helped her build her portfolio. While I strongly support thinking ahead and building a portfolio over time, it is also important to maintain flexibility and not get committed to too much.

Another friend who is an animal lover balances her interest in retirement issues with volunteering for PAWS Chicago. (PAWS Chicago is a champion for animals, rehabilitating injured and orphaned cats and dogs, providing shelter and adoptions for them, and educating people to make a better world for animals and people.) She has been able to use the skills from her working career in several ways. She does training, helps provide computer support, and helps match cats to families. The training uses her consulting and presentation skills, the computer support uses some of her technical and financial skills, and the matching builds on the skills she had in working with clients and supervising employees. The skills that actuaries have through their working careers can be valuable in many different settings.

Implementing The Life Portfolio

Building a brand and using it: It is important to define how you want to be identified, and what you want people to ask you to do, once you are in retirement. Today, many people are aware of the need to build a brand earlier in life, and to use it to manage a career. That need does not go away for a phased retiree. In fact, since there are no well-formed expectations about what a phased retiree might do and how such a person fits in, the need tends to intensify.

For people who have held senior positions or visible roles, there is a choice between being known as “Me, today,” “Me, former chief actuary of XYZ,” or “Me, former president of the Society of Actuaries.” My experience is that preferences vary. I have chosen primarily to be “Me, today,” but the former roles are in my bio.

I participated in a panel on Women’s Leadership several years ago, and I commented that it is also important to remember that appearance is a part of branding. Women particularly can be remembered because of what they know, because of how they look, or both. My view is that it is desirable to dress and maintain an appearance that supports one’s professional goals and is not a distraction. However, as a phased retiree, I feel I have more freedom to make personally appealing choices with regard to jewelry, colors, etc. However, if my goal were to get appointed to corporate boards, a goal held by many phased retirees, then it would be extremely important to dress that part and maintain an image that would make people comfortable with me in that role.

Part of using your brand is communicating it. After retiring from Mercer at the end of 2004, I established Anna Rappaport Consulting in 2005. Once I did this, I developed a communication strategy.

Use of technology/website/social media: Technology has been critical to my life portfolio choices. The professional work I do can be largely done from any location, whether online or by telephone. Access to a good computer and printer is key.

However, one of the things I no longer automatically have access to is “tech support” from my employer. I still need support, and it has been invaluable to find a local person who can come to my house and help when I have a problem or need something set up. An early step in making retirement work can include upgrading technology, including telephones, internet service, computers, printers, etc. Finding a quiet nook at home to work from – the substitute for the office one used to have – is also important, though many people may already have what amounts to a home office during their working years.

For me, an important part of telling my story has been to have a website. My website was first developed in 2005, and it has been periodically updated. The development work also helped me to define my story better. (The story was also put on a brochure. The brochures were extremely helpful in the first three years to tell people about what I am doing.) Today, social media would probably play a more prominent role in telling the story. Individuals vary with regard to their view of the importance of websites and social media, and what strategy they chose. These issues are a critical part of the implementation of a retirement-Pursuits communication strategy today.

Others thinking about this may be interested to know that I used professional help both in formulating the story and in implementing the website, and for me, that help was critical. A former colleague relayed to me that she used her employment exit package at an outplacement firm to plan her next life phase.

Securing opportunities: Finding opportunities is an important part of meeting one’s goals (and therefore, of implementing the life portfolio). Opportunities most often happen because of seeds that have been planted along the way.

As a phased retiree, I have learned that there are many pro bono roles available, that they can be very gratifying, and that people appreciate good work. It has been much more challenging to get paid consulting work, and more difficult than most people think it will be. The same is likely also true about gaining Board appointments.

For any individual, I believe there is also an issue of deciding what one is professionally qualified to do, can manage and most importantly, what one wants to do. This answer will differ for each individual. I encourage people to be realistic as they think about these trade-offs and constraints. It is also important not to take on so much that it becomes overwhelming.

My strategies for keeping my story in front of people include maintaining contacts, participating in committees, in-person meetings, updating my website, use of social media, and periodic letters to tell people what I am doing. I keep up with people, and when I am traveling, I try to connect with people in that area beyond the meeting I am attending. On a number of occasions, I have organized a dutch-treat dinner with a small group. The dinners have been a great success.

I also mail out update letters, which help me remind people that I am still professionally active, and what my interests are. Every year or two I have sent out a paper letter to more than 200 contacts updating them on what I have been doing. While this seems very old-fashioned, I get many compliments on the letters. Because few people do this today, I think they stand out and help people to remember that I am available and professionally active.

Measuring life portfolio success: As a phased retiree, my life is very focused on meeting my personal goals. A simple way of deciding if things are working out is to periodically (at least once a year) think about what one has been doing. If you are doing things that you are happy about and proud of, then I would call that a success. On the other hand, if you do not have a story about accomplishments that you feel are worthwhile, then it may be time to rethink your goals and strategies.

Sometimes we get diverted from doing what we want to do because of the care and support needs of family members. From my perspective, that is also important. Part of choosing what to put in my life portfolio (or not) is the ability to change priorities when family and personal circumstances change. This can be a very important part of one’s life portfolio, and family issues can be the biggest commitment for a long or short period.

Time management: Time management is entirely different than while one is working, but it remains very important. Time management during retirement requires new skills, discipline, the ability to set priorities, and insight into when it is best to say “no.” With regular employment, one usually has a defined structure to the week. As a retiree involved in different activities, every day may be different, and there are still commitments that require adhering to schedules. One has many options about what to do, and it is important to be able to choose and prioritize. It is also important to be able to decide how much time to spend on a project before moving on to the next.

It is valuable to have flexibility in our schedules so that, as we meet new people and encounter different ideas that sound interesting, we have time to test them out and see if they are appealing. One of the advantages of being retired is that we can experiment with going down different roads and seeing what we might find.

Other observations: I have tried to avoid overhead so that I am not under pressure to earn a minimum consulting income just to support that overhead. I do not have employees or an outside office.

Some support is essential to me, though. That includes a local tech support person who comes to the house, website support, someone who can help with editing and making Powerpoint presentations look professional, and peers who are available to review articles. Family members and friends have been essential to my solutions to these challenges.

In addition to existing contacts, individuals may wish to make new ones tailored to this life stage and emerging interests. There are a variety of organizations that can help people find their next steps, connect to other seniors, or pursue a special interest. The Village Movement consists of organizations designed to connect seniors to resources and to each other in their own location. Skyline Village in Chicago is an example of such a group. The Transition Network is a national group for women transitioning into their next steps. It has 14 chapters.

How Advisors Can Better Help Retirees (With Their Life Portfolio)

I hope this article will be of interest to advisors who are trying to help clients design their own life portfolios and make phased retirement work for them.

At a minimum, the advisor who is working on a financial plan for retirement needs to pay attention to several issues, as their retiring clients (consciously or not) make decisions, particularly regarding the Pursuits area of their life portfolio:

- It is very important not to divert assets needed for living in retirement into supporting a new business or activity. If retirement needs are funded, then assets over what is needed can be invested to support these activities. (One of my advisor friends offered an example of investing in a post-retirement business gone wrong. His contact invested about $700,000 gradually over four years in a venture that never made it. For many people, that would devastate their retirement assets.)

- For people who want to scale down gradually and move into some different activities before leaving paid work entirely, there are challenges in projecting income going forward. If the individual is going to work on their own, income should be calculated as net of Pursuit expenses, unless one is well off enough to subsidize the work. The advisor needs to determine how to fit this activity into the plan, and may look at multiple scenarios.

- If a business or activity will generate expenses, they should be factored into the plan.

The advisor can decide if they wish to go beyond what is needed for the financial plan and assist the client in building their life portfolio, but at a minimum, the financial plan should consider and support whatever the client’s life portfolio is going to be.

If the advisor plans to provide help with the life portfolio, then there are a variety of business questions to answer. For instance:

- How much help will we provide?

- How will we be paid for our work?

- Do we need to gain additional expertise? Will we partner with others who have some of the added expertise needed?

- Should we provide information about resources to help clients achieve their goals, evaluate different communities and options, find any support that may be needed, and find activities (Pursuits) consistent with their life portfolio?

- How do we bring analysis of the life goals and financial goals together?

The advisor’s clients may make choices that require them to deal with specific tasks, such as contracting, writing engagement letters, protecting intellectual property, managing technology, and managing professional and business liability. These are specific issues that someone who sets up a new business or does consulting may face and may need help with. The advisory firm needs to decide whether they will assist with any of these tasks, and if not, whether they do internally, or whether they will identify outside resources and make referrals, or partner with those resources who can offer support.

For advisors seeking more information, the SOA Committee on Post-Retirement Needs and Risks has resources to help people think about retirement. It recently developed two new publications, Retirement Health and Happiness and Retirement Planning From Start To Finish, which were jointly sponsored with Financial Finesse. These are the first two in a series of publications designed to help improve retirement literacy. They provide information for people nearing retirement and retirees on aspects of retirement planning that go beyond money.

The SOA supported the Stanford Center of Longevity Sightlines project. This project examines what is needed for a long and successful retirement. It focuses on three domains of importance: financial resources, health, and social engagement. The ideas presented in this project support the need for adopting strategies similar to those in Retirement Health and Happiness.

The SOA Committee on Post-Retirement Needs and Risks also has developed a set of 12 decision briefs to help individuals make a range of decisions as they near and enter retirement. One of these briefs is about the timing of retirement.

There are a number of organizations specializing in helping retirees find or develop opportunities. RetirementJobs.com, Your Encore, and Encore each offer different approaches to the challenges at hand.

Concluding Advice

Retirement is a time of transition. At that point, we move away from established long-time obligations, to a period of new activities and new freedom. We have many choices and challenges as we build our own life portfolios.

We might need to build or enhance skills in order to work longer, pursue our passions, realize our goals and do the tasks in our life portfolio. If we are serious about pursuing passions and/or longer work, we should be realistic about building those skills and should be willing to invest time, effort and money in doing so.

There are a number of educational opportunities specifically designed for seniors. The Osher Lifelong Learning Institutes (OLLI) are operated at more than 120 campuses in the United States. Skyline Village helped me realize that there were several good educational opportunities and other resources within a few miles of my Chicago home. There is an OLLI at a local university. The University of Chicago operates the Graham School. A large local church has a Center for Lifelong Learning, and I came to realize that there were good nearby opportunities if I just looked around. Friends in Boston and Washington, D.C. have told me the same thing about their communities. In addition to the local classes, there are also many online classes.

Here are some final tips to share… I hope that they will help individuals and their advisors plot their own retirement journeys.

- Start by understanding your financial situation, and make sure that you have the resources to pursue the path you are interested in. If you need more money before leaving conventional work, try to work longer. Don’t forget about replacing your health care benefits (especially if you are not yet eligible for Medicare).

- The right answers for you are personal. It is important to find your passions and choose activities that create value based on your personal sense of value. Take some time to find your direction, and be prepared to make adjustments over time.

- When you become independent, you can focus on pleasing yourself and not others, and you have your own voice. For some people, having their own voice is very important.

- Keep your spending at a level that lets you make choices. Before spending significant amounts of money, ask the question: What value will this add to my life? A major expenditure may mean limiting your options to reboot or to move to a more interesting, but less lucrative role.

- Take steps to maintain your health. Your vitality, longevity, and effectiveness depend on your physical capability.

- If you are part of a couple, remember that your spouse or partner may pass away. Have a plan that will work for you while you are with the partner, and later on when you are on your own.

- If your long-term employer offers flexible work options, check them out. Some employers are willing to negotiate arrangements that work well for people, and some bring back retirees to do occasional work after retirement. Most people build their own paths, but do not assume there are no options at a long-term employer without doing some checking first.

- Establish your brand and be prepared to communicate it. Do you prefer to be “Me, today” or “Me, former chief actuary of XYZ”? I chose “Me, today.” People I have talked with go both ways, but more are in the “Me, today” camp.

- Think longer-term. You may live to 95 or 100, or more. Some activities are sustainable for a few years only, but others can last longer. I personally like the idea of having a “portfolio of activities,” some of which can be sustained even if you have limitations.

- It is challenging to learn to manage your time when leaving the structure of a job. Work on your time management skills.

- Pay attention to the details. You will need to function without the support structure you were formerly used to. If you are going to do paid consulting, there are practical issues to deal with including technology, how to get work peer-reviewed, contracting, invoicing, protecting intellectual property rights, the possibility of professional liability if something goes wrong, and more.

- Some things require a lot of vitality. Do them now while you can. You never know when limitations are coming.

This article originally appeared on the Nerd’s Eye View.

There are no comments for this article yet. Be the first to leave a comment