Crafting Your Legacy: Diverse Perspectives on Making a Meaningful Impact

Leaving a legacy can mean vastly different things to different people and is a highly personal concept. Overall, most say it boils down to how you are remembered. For example, do people feel that you made a positive contribution? Were you connected to something bigger than yourself?

The Age-Friendly Institute surveyed a nationally representative sample of age 50+ adults via AgeFriendly.com. Not surprisingly, answers varied, including comments such as these about what leaving a legacy means:

- “Leaving something behind that helps other people live better lives.”

- “To me it is making sure my children have high moral standards. Raising them to be responsible, hardworking adults is important to me. I will leave them what financial assets I can, but my priority has been to raise exemplary humans”

- “Ensuring that the family and friends I leave behind have images and memories of me that bring them peace and joy.”

- “Letting my children and grandchildren see how important they are to me, and setting a good example for them to follow. Helping them to meet their needs and goals. Going to church and donating time, efforts and tithes.”

- “Evidence of my family's contribution to the world, our community, and our family.”

- “A legacy to me means to leave a life accomplished and a story to tell or share with my surviving relatives. One of the things that has made me rethink my legacy is that it is not my mission or goal for my kin to create dreams based on my expectations, but it is my goal to leave the world with a mark to be remembered by.”

When asked how they are working towards their legacy, many say they volunteer (33%) and mentor others (32%). Others focus on creating art (23%) and documenting their family history for future generations (43%). A large proportion are focused specifically on their family, supporting them financially (40%) and helping with childcare (22%). The largest proportion (55%) said they are working towards their legacy just by “living their best lives”.

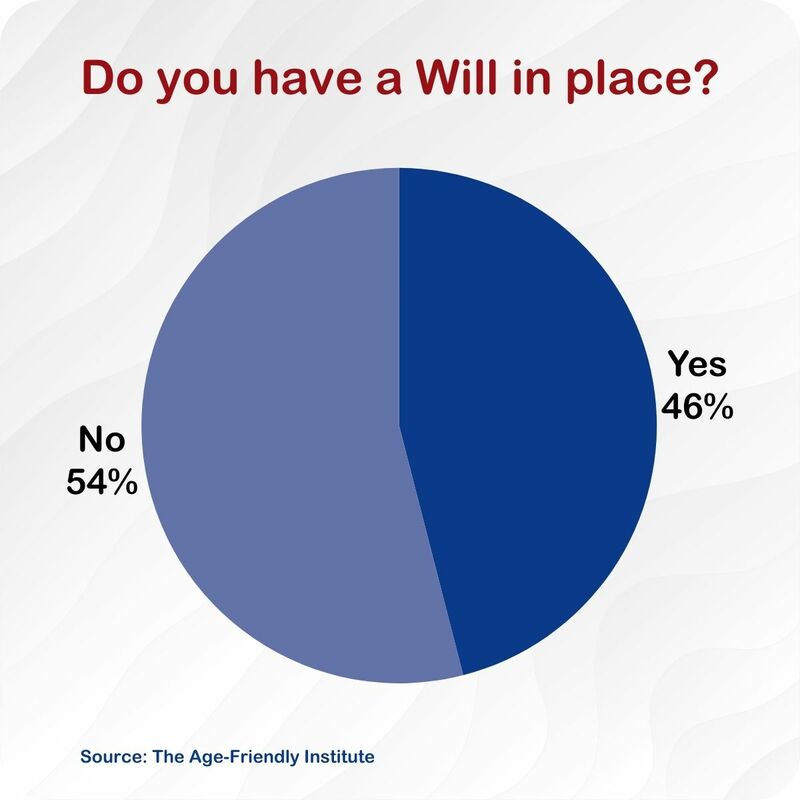

Only 46% say they currently have a will in place as a part of a formal estate plan, a number which only rises to 53% when limiting the scope of respondents to those aged 70+. 62% saying they plan to make their wishes known in a will.

When asked what other affairs they have in order, topping the list was an advanced healthcare directive (36%), a living trust (26%) and a durable power of attorney (25%). One in 5 people included long term care insurance as a part of their plan. Others (15%) have written directives and instructions which are not in legally binding documents.

From the perspective of leaving a financial legacy, the largest proportion of those surveyed are planning to detail their wishes in a traditional will (62%), planning to leave funds in a trust for their descendants (33%) or to charity (19%) or setting up a charitable remainder trust/gift annuity (11%). Others are taking action to disperse funds now, planning to leave behind as little as possible (12%) or to transfer assets to descendents in advance to avoid taxes and paperwork (13%).

Few (22%) have discussed the details of their plans with an executor or beneficiaries and only 28% said they have a completed estate plan. When asked why they didn’t have one, the largest percentage (25%) said they don’t have enough assets to worry about or they just haven’t gotten around to it yet (23%). Some don’t know how to get started (12%) or feel the process will be too expensive (9%). Others naturally find the topic difficult to think about (9%) or a difficult one to discuss with their families (7%). Like any other housekeeping project or goal, though, the process starts with a plan and deliverables which can be as small as letting people know where your important papers are and documenting your wishes.

When asked what advice they would give to others on how to leave a legacy, survey respondents were both practical and ready to share their philosophical advice:

- Live life to the fullest! Share, don't be greedy, don't continue to be mad with one another and hold a grudge for ever. Life is too short not to speak with family and friends.

- "Follow your heart and mind. Work with professionals. Family is not always the best or knowledgeable on personal affairs regardless."

- "Think it out, put it on paper and revisit often prior to executing."

- "Live as a role model for your descendants. Help them when and if you can. Do God's will. Love with all your heart."

It is never too late to work on delivering a legacy, whatever that may individually mean for you. Whether you seek the assistance of professionals to maximize savings or draft a will or spend time with loved ones to share treasured memories and mementos, working on your legacy can help to cement feelings of accomplishment and a life well lived.

The Age-Friendly Institute surveyed a nationally representative sample of older adults age 50+ in January/February 2024. There were 116 respondents.

There are no comments for this article yet. Be the first to leave a comment